DeA Capital Real Estate SGR S.p.A. is the leading asset management company in Italy, specializing in real estate alternative investment funds (AIFs). It manages € 12.2 billion in assets through 50 real estate funds, 2 of which are listed on the MIV segment of the Italian Stock Exchange and a SICAF.

DeA Capital Real Estate SGR S.p.A. is a leader in the Italian real estate market, with assets comprising over 670 properties, 60% of which are located in Rome and Milan, and an important portfolio of partners, consisting of approximately 100 Italian and international institutional investors.

DeA Capital Real Estate SGR S.p.A. has always shared and promoted the principles of ethics, legality and respect for human rights as well as current regulations, placing them at the basis of its strategy. The SGR is aware that the management of risks and opportunities related to Environmental, Social and Governance (ESG) issues and the integration of the related factors in the investment process support the creation of value and growth in the medium-long term.

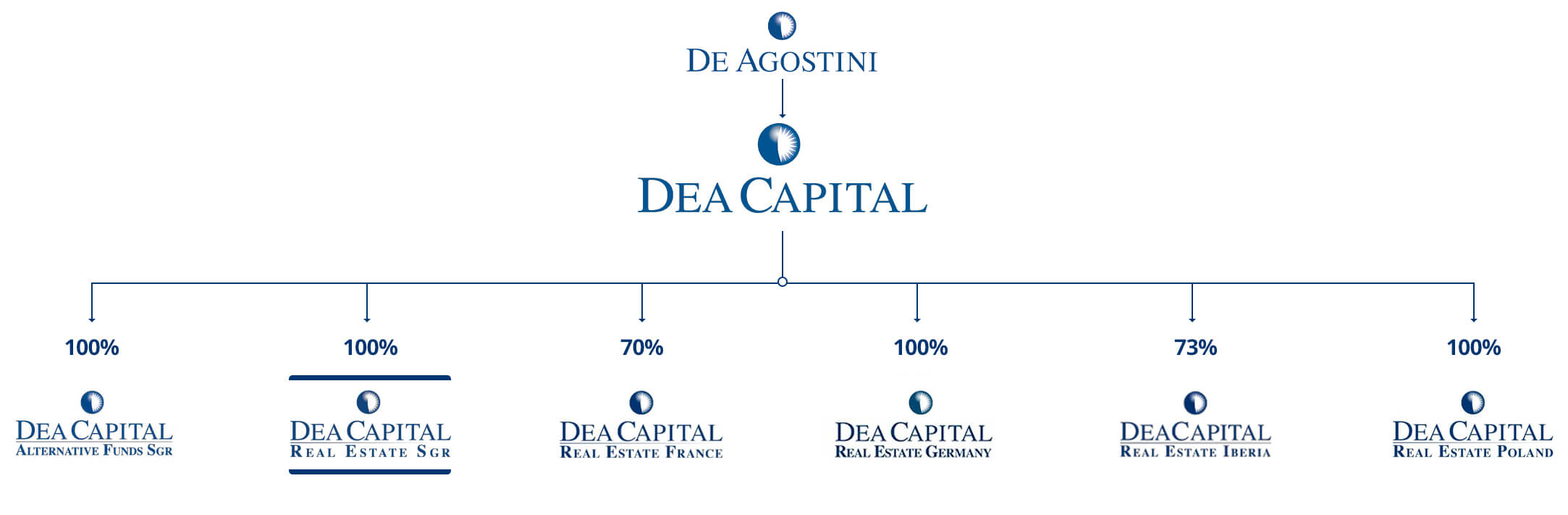

DeA Capital S.p.A. is the independent platform, leader in the Alternative Asset Management sector, with investment activities in Private Equity and Real Estate, Euro 25,6 billion AUM, over 450 Investors, 90 Funds and 250 Employees.

After the activation of the new companies in France, in the Iberian Peninsula and Poland, the internationalisation of the Group continues with the début in Germany, also through Group subsidiaries and investees of local Senior Management Teams, with significant experience in the sector.

The objective is to create a pan-European investment platform with the aim of investing in all sectors and with a diversified investment risk profile, from Opportunistic to Value-Add to Core+, on behalf of the Group and also for Institutional Investors. The Platform plans to complete the development plan in target markets, with Luxembourg.